- 16 Jul

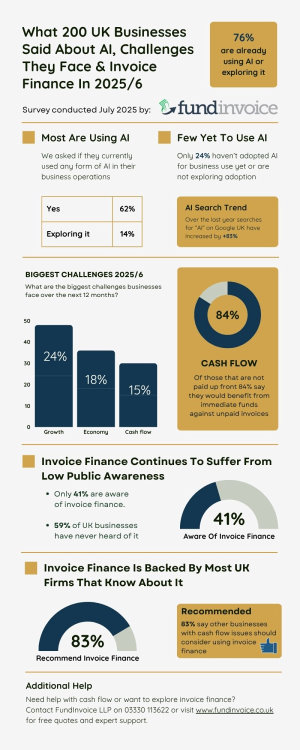

What 200 UK Businesses Said About AI, Cash Flow and Invoice Finance

This article shares the research results from our survey of 200 UK business owners on AI usage, business challenges in 2025 to 2026, and awareness of invoice finance. To learn more about how invoice finance works, visit our invoice finance page.

IMPORTANT NOTE: You are welcome to quote or reshare these results, provided you attribute them to FundInvoice LLP and provide a link back to this page.

What 200 UK Businesses Said About AI and Invoice Finance

We recently surveyed 200 UK-based business owners to get their views on artificial intelligence (AI), business challenges over the next year, cash flow, and invoice finance. Here's what they said.

AI Usage Among UK Businesses

We asked: Do you currently use any form of AI in your business operations?

- Yes: 62%

- No: 23.5%

- We are exploring it: 14%

- Don't know: 0.5%

A combined 76% are either using AI or exploring its use in their businesses. Only around a quarter said they don't use AI at all and are not exploring its use.

See related research about the use of AI in businesses from the Office for National Statistics.

The Biggest Challenges Facing Businesses Over the Next 12 Months

We asked: What are the biggest challenges facing your business over the next 12 months? (Respondents could choose more than one)

The top concerns for the next 12 months, 2025 to 2026, were as follows (percentage of responses):

- Growing sales: 24%

- Economic uncertainty: 18%

- Cash flow and funding: 15%

- Technology and cybersecurity: 11%

- Competition: 9%

- Adopting artificial intelligence: 7%

- Talent and staffing: 7%

- Regulatory and compliance issues: 4%

- Supply chain issues: 3%

- Other: 2%

Sales growth emerged as the top concern, followed by economic uncertainty and then finances. Technology, staffing, and AI adoption itself also featured.

The Importance of Faster Customer Payments

We asked: Would your business benefit from customer invoices being paid immediately?

- Yes: 60.5%

- Payments are already immediate: 28%

- No: 11.5%

Nearly two-thirds said their business would benefit from instant payments, suggesting that many firms still experience delays with customer payments. This means that of those not already receiving immediate payments, 84% say they would benefit from invoices being paid immediately. Immediate cash against unpaid invoices is the key feature of invoice financing facilities such as invoice factoring and invoice discounting.

Awareness of Invoice Finance

We asked: Have you heard of invoice finance (also called factoring or invoice discounting)?

- No: 59%

- Yes: 41%

Despite being a standard business funding option, invoice finance remains underpublicised, with more than half of UK businesses unaware of it.

Has The Level Of Awareness Changed?

We conducted similar research in 2016, which found that 32% of respondents were unaware of these services at that time. That number has risen to 59% in these new findings, suggesting that the position has deteriorated further.

Should Businesses Consider Invoice Finance?

We asked: Do you think businesses with cash flow issues should consider invoice finance to release money against unpaid invoices immediately?

- Yes: 83%

- No: 17%

Once presented with the concept, a large majority felt that invoice finance was a sensible option for businesses facing liquidity challenges.

For more information about these products, please see our main invoice finance page.

COMPARE INVOICE FINANCE QUOTES

Summary of Key Research Findings

These are the key findings from this survey:

- AI adoption is widespread, with most businesses either utilising or considering its implementation.

- The top three challenges businesses face over the next 12 months, from 2025 into 2026, are growing sales, economic uncertainty, and managing finances.

- Immediate payment of invoices would help the majority of businesses.

- Awareness of invoice finance remains limited.

- Once explained, most believe invoice finance is a viable solution for working capital pressures.

Why This Matters

With growing sales, economic uncertainty, and working capital pressures among the top concerns for UK businesses, it’s important that more firms understand how solutions like invoice financing can unlock funds tied up in unpaid invoices. Our research highlights a clear awareness gap and confirms that most business owners recognise the value of these services once they are aware of them. FundInvoice believes there is a strong case for trade bodies, such as UK Finance, and even government-backed business support initiatives, to continue to help raise awareness of these options, so that more UK businesses can access the funding they need to succeed.

Infographic Of The Results

Below is an infographic of the survey results. You are welcome to download and share the infographic (unaltered), provided it’s attributed to FundInvoice LLP with a link back to this page. Click on the image for a higher-resolution version, or you can download a PDF version of the infographic.

Further Information And Support

For a deeper look at how AI is being used within the invoice finance industry, read our dedicated article here.

You can find details of our other research and studies in our research archive.

If you would like help understanding how invoice financing could work for your business, or to discuss these findings further, please don't hesitate to contact our team on 03330 113622 or visit www.fundinvoice.co.uk.

Source: FundInvoice LLP AI, Business Challenges & Invoice Finance Survey, July 2025 of 200 UK-Based Business Owners

- Home

- Business Financing

- Invoice Finance

- Invoice Discounting

- Factoring

- Debt Factoring

- Recourse Factoring

- Fund Selected Invoices

- Business Loans

- Construction Sector Funding

- Protect Against Bad Debts

- Exports Collection And Funding

- Import Funding

- Body Shop Funding

- Spot Factoring

- Retail Sector Funding

- Fund Invoices Confidentially

- Help Running Your Payroll

- CHOCs Customer Handles Own Collections

- Collect Invoices Confidentially And Funding

- Outsourcing Your Credit Control

- Asset Finance And Mortgages

- Case Studies

- About Us

- Testimonials

- Find Out More

- News

- Free Magazine

- Blog